In the vast and complex landscape of the United States, the insurance industry plays a pivotal role in providing security and peace of mind to millions of individuals and families. From health insurance that ensures medical care is accessible to auto, home, and life policies that safeguard against unforeseen events, the insurance market in the U.S. is not just a business—it is a fundamental pillar that contributes to the nation’s overall safety and stability.

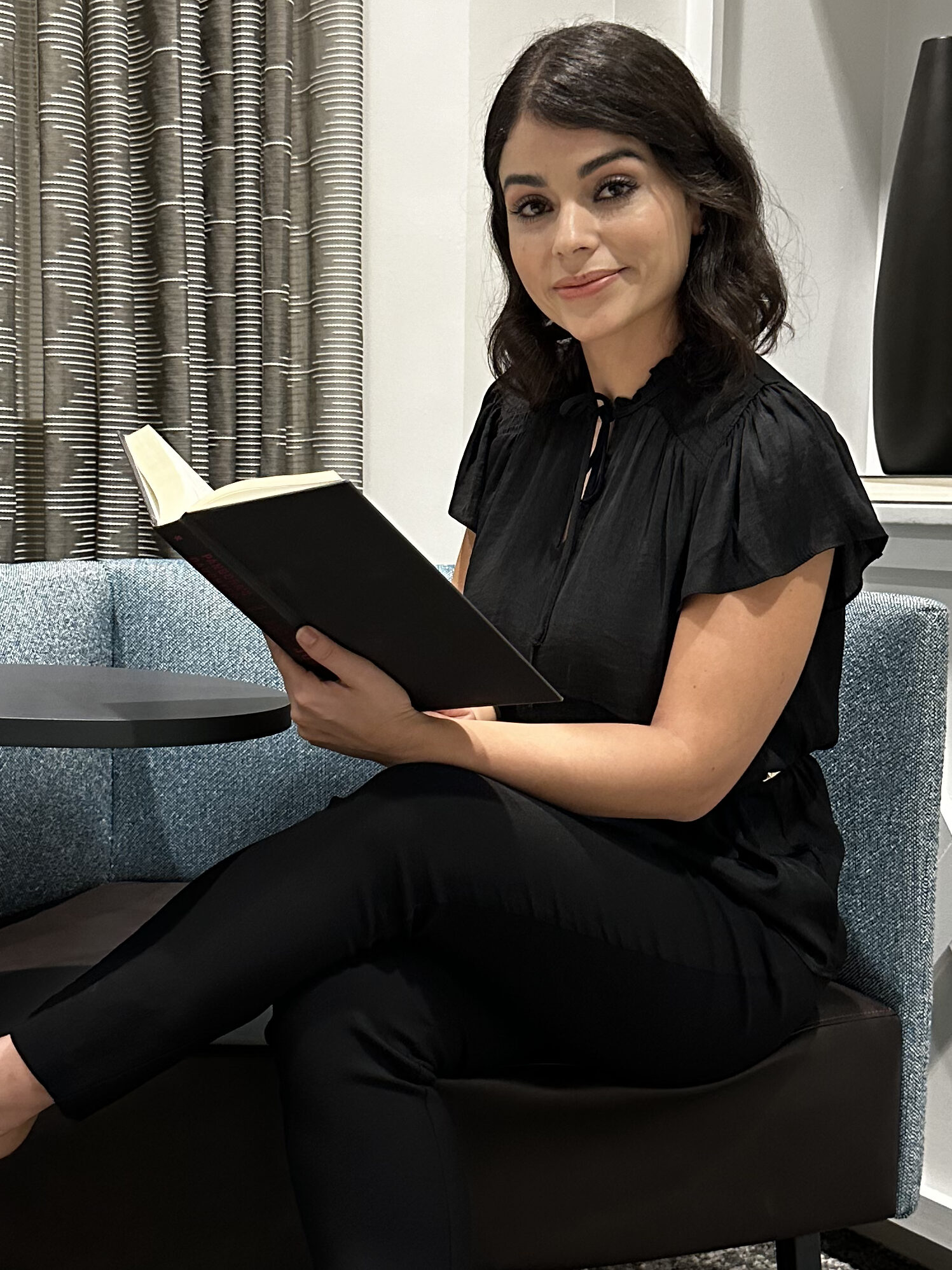

One of the most insightful voices in this field is Larissa Catita Escobar, an insurance expert who is building a remarkable career in the U.S. While her journey in the industry began in Brazil, Larissa has quickly gained recognition in the American market for her expertise and innovative approach to risk management. She recently released a book in Brazil titled “Além da Apólice: uma visão do universo de seguros do Brasil” (Beyond the Policy: a vision of the insurance universe in Brazil), which was met with great success. The book has now been translated into English, and Larissa is eager to share her knowledge with U.S. professionals and consumers alike.

When reflecting on the broader role of the insurance market in U.S. society, Larissa underscores the importance of the industry in providing a framework for security. “Whether it’s health insurance that covers medical costs, auto insurance that protects drivers, or home insurance that shields families from the financial burden of natural disasters, insurance is the backbone of safety in this country,” she says.

Indeed, the insurance market is central to how Americans navigate the risks inherent in life. It empowers individuals to take on new challenges and opportunities, knowing that a safety net is there when things don’t go as planned. By ensuring that people have access to the protection they need, the U.S. insurance industry contributes to a culture of security that makes the country a safer and more predictable place to live.

Building a Career in the U.S.

Larissa’s passion for insurance began when she was studying marketing in Brazil, but she quickly realized that her true calling was in the insurance sector. “I always knew that insurance was more than just about numbers and policies—it’s about providing people with the security they need to live their lives with confidence,” Larissa explains. “That’s why I chose to dedicate myself to this field, and now, as I continue my career in the U.S., I see firsthand how essential the insurance market is to creating a safer society.”

Her transition to the U.S. market hasn’t been without challenges, but Larissa has embraced every opportunity to learn and grow. “The insurance landscape here is vast, but it’s also incredibly innovative. There’s so much room for new ideas and improvements that can make a real difference for people,” she says, highlighting how the American insurance industry is uniquely positioned to support both individuals and businesses with a diverse range of policies.

Larissa’s expertise lies in helping people understand the importance of insurance in risk mitigation, whether it’s through health coverage or protection for homes and businesses. “Insurance is more than just a safety net; it’s an integral part of the fabric that allows people to live freely and without constant fear of financial ruin. When the unexpected happens, insurance is what helps people rebuild their lives,” she adds.

Spreading Knowledge Across Borders

Larissa’s book is not just a guide to the insurance industry—it is a tool for empowerment. In her writing, she emphasizes how insurance can be a transformative force for individuals and families. “The book was a way for me to give back to the industry that has given me so much. I wanted to help people understand that insurance is not just a product to buy, but a vital service that makes life safer and more predictable,” Larissa says, discussing the impact of her book in both Brazil and now in the U.S.

When it is released, Larissa has the intention to be traveling across the U.S., speaking at industry conferences, and collaborating with insurance companies to promote a more holistic understanding of risk management. “The more people understand how insurance works, the more they realize how integral it is to their daily lives. I want to bring that awareness to as many people as possible,” she explains, with enthusiasm.

Her work is already making waves. Larissa’s unique perspective as a Latin American woman in a predominantly male industry has earned her recognition as a thought leader in the insurance world. She has been invited to share her insights on podcasts, webinars, and at major events—helping to shape the future of insurance in the U.S.

In a recent study conducted by industry analysts, it has been revealed that women constitute a significant majority of the insurance industry’s workforce, comprising approximately 60% of its employees. However, when it comes to occupying top corporate positions and board director roles, their representation dwindles significantly, with only 18% holding corporate officer positions and a mere 11% serving as board directors.

Despite the disparity in leadership positions, the insurance industry remains a vital economic contributor, with substantial revenue generation. The industry’s continued growth underscores its significance in driving economic stability and resilience.

The positive outlook extends beyond the industry itself, as increased gender diversity and equity in leadership roles have broader economic implications. “Studies have shown that companies with diverse leadership teams tend to outperform their counterparts, fostering innovation and better decision-making” explains Escobar. “Therefore, closing the gender gap in insurance leadership not only promotes fairness but also enhances overall business performance and economic prosperity”, says.

As the industry continues to navigate the path towards greater gender diversity and equity, there is a collective call for action to dismantle barriers and create opportunities for women to thrive in leadership roles. With the expertise and dedication of professionals like Larissa Catita Escobar, coupled with a commitment to inclusive practices, the insurance sector can realize its full potential as a beacon of diversity and progress.

“I always knew that insurance was more than just about numbers and policies – it’s about providing people with the security they need to live their lives with confidence”

Family Life and the Future Ahead

When she’s not working on her book, writing articles, or giving speeches, Larissa enjoys spending time with her husband, who has been a constant source of support throughout her journey. The couple met in Brazil, and after marrying, they decided to make the U.S. their home. “She’s extraordinary in so many ways,” says her husband, Júlio Escobar. “Not only is she a brilliant professional, but she’s also an incredible wife. I’m so proud of all she’s accomplished, and now we’re excited to be waiting for our first child.”

Larissa beams when speaking of her family life. “I feel blessed every day to have a partner who believes in me and supports my dreams. Júlio has been with me every step of the way, and now, with a baby on the way, we’re both excited for this next chapter of our lives.”

Larissa’s career and personal life are deeply intertwined. “I am driven by the desire to make the world a better place for my family and for others,” she reflects. “Insurance allows me to contribute to that vision by helping people protect their futures. And with a baby on the way, I’m even more motivated to continue working to make this country a safer place to live.”

As Larissa continues to share her knowledge and experience, her work is helping to shape the future of insurance in the U.S.—and in turn, creating a safer, more secure environment for generations to come.

With the launch of her book and her continued advocacy for better risk management, Larissa Catita Escobar’s career in the U.S. is not just a success story—it’s a testament to the power of knowledge, hard work, and a commitment to building a better future for everyone.